Target: A Retail Powerhouse Firing on All Cylinders

- lelinvestmentllc

- Mar 5, 2024

- 2 min read

Key Takeaways:

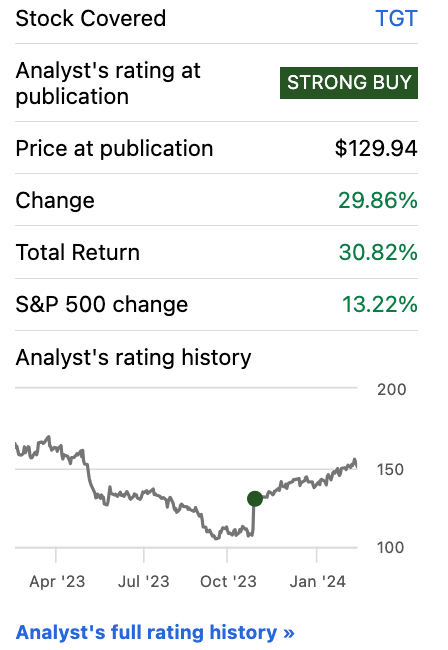

Target's stock has surged 26% since receiving a Strong Buy rating

The company's strategic focus has paid off, despite inflationary pressures

Target continues to lead in margin among retail peers

The stock remains undervalued, presenting an attractive opportunity

Stock Performance and Outlook

Target's stock has been up 26% since our initial coverage with a Strong Buy rating in November 2023. The stock had been hammered as part of the sluggish consumer demand due to inflationary pressures. However, we had a different opinion than Mr. Market, as we believed Target's focus on product selection and convenience, as well as partnerships with affordable beauty brands, positioned it well in the retail industry.

Impressive Q4 Results

In Q4, Target continued to expand its gross margin rate to 25.6% and operating income to 5.8%. This also indicated a remarkable 60% increase in operating income, showcasing a very successful strategy under the inflationary environment.

Industry-Leading Margins

This achievement puts Target in a continued position to lead in margin across the retail industry compared to its strong peers such as Walmart and Costco. Higher margins further build a formidable economic moat to compete effectively in the coming quarters.

Attractive Valuation

Target's stock remains relatively undervalued compared to its peers, presenting an attractive opportunity for investors.

Conclusion

We remain highly bullish on Target. Despite inflationary headwinds, the company's strategic focus on curating products, providing convenience, and partnering with affordable brands has fueled impressive performance - evidenced by the 26% stock surge since our initial Strong Buy rating.

Target's outstanding Q4 results, with expanded gross margins of 25.6% and a remarkable 60% increase in operating income, showcase its ability to execute successfully in tough economic conditions. The company's industry-leading margins give it a powerful competitive edge over peers like Walmart and Costco.

Notably, Target's stock remains undervalued relative to its retail counterparts, presenting an attractive investment opportunity. We reaffirm our Strong Buy recommendation for investors seeking long-term growth potential backed by Target's strong fundamentals and stellar execution.

Comments