The PDD Powerhouse: Dominating E-Commerce Amid Geopolitical Challenges

- lelinvestmentllc

- Mar 20, 2024

- 4 min read

Summary:

PDD faces potential legal risks in the US, but its low-cost retail model may make it a less concerning target compared to TikTok

PDD's refund-only policy is now being adopted by rivals, but its direct-to-manufacturer approach gives it advantages

PDD's competitive moat remains strong, with the company continuing to grow overseas and take share in China

We maintain a strong buy rating on PDD, with an updated base case of $163 per share, representing 13% upside

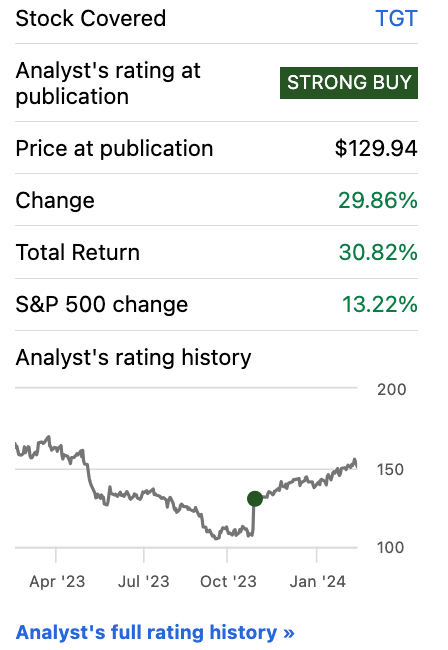

Back in November, we laid out our thesis on why PDD is successfully challenging e-commerce giant Alibaba, and why we believe PDD will continue to give Alibaba a run for its money.

Why PDD Pulled Back During the Quarter

Before reporting, PDD's stock dropped to 127 from 152. It seems there were a few factors that contributed to PDD's pullback during the quarter. From what we can tell, one of the key concerns appears to be potential legal risks the company faces in the U.S. market.

Potential Legal Risks from US Government

The Chinese e-commerce giant that owns Temu, PDD Holdings, has come under increased scrutiny from U.S. lawmakers. There's been a lot of focus on Temu's supply chain and trade practices, and a recent bill was proposed to force TikTok's Chinese parent company ByteDance to cut ties. This has highlighted the risks Temu may be facing in trying to expand its presence in the U.S.

What we think:

Now, we know some folks might be worried that this legal uncertainty could hamper Temu's growth prospects in America. But from what we can gather, the US government may be more welcoming of PDD compared to TikTok. The thinking seems to be that since Temu is just a low-cost retail platform, it doesn't pose the same national security risks as a social media app like TikTok that could potentially sway online opinions. Plus, Temu's low-price goods could even help temper inflation in the US, which we're sure the government would appreciate. So we don't believe PDD is facing any truly material legal threats in the US market at this point.

2. Refund-Only Policy Adopted by Rivals

Another factor that may have contributed to PDD's pullback is the fact that its major rivals Alibaba and JD have now also adopted a "refund-only" policy similar to PDD's. As we discussed last time, this refund-only model really helps PDD by transferring quality control responsibilities to the consumer rather than the platform. It lowers PDD's operating costs and boosts margins - we saw their SG&A as a percentage of revenue drop significantly even as their cost of goods sold rose.

The interesting thing is that this refund-only model may actually work even better for PDD compared to Alibaba. That's because PDD works directly with manufacturers, while Alibaba deals more with third-party merchants. So the refund policy tends to hurt those higher-margin merchants more than PDD's manufacturer partners. Plus, PDD's strong position in the agriculture category gives it an edge in traffic acquisition that Alibaba and JD can't easily match.

Valuation

We've taken another close look at PDD, and we're feeling pretty optimistic about the company's prospects. In fact, we're updating our base case price target on the stock to $163 - that's about 13% higher than where it's trading right now.

Now, we know what you might be thinking - 13% upside, that doesn't sound all that exciting. But hear us out, because we actually think that's a pretty conservative estimate. The way we see it, we're only factoring in around 3% annual growth for PDD after 2025. And given how rapidly the company has been growing its profits - we're talking triple-digit growth rates here - we just don't think that 3% number is doing justice to PDD's potential.

In fact, if you look at the stock's PEG ratio, it's still less than 0.8x. That tells us the market still hasn't fully priced in just how fast PDD has been growing. And with the company continuing to have success expanding overseas while also taking market share away from giants like Alibaba in China, we honestly wouldn't be surprised to see PDD hit new all-time highs very soon.

Look, we know there's always going to be some risk and uncertainty when it comes to investing, especially with a company like PDD that's operating in some volatile geopolitical waters. But when we step back and look at the fundamentals - the rapid profit growth, the strong competitive position, the long runway for expansion - we just can't help but feel really bullish on this stock. Our $163 price target may be conservative, but we're confident PDD has the potential to handily outperform from here.

Conclusion

All in all, we really think PDD has some impressive competitive advantages and a sturdy business moat that will allow it to continue thriving, even as rivals copy aspects of its model. Our updated base case has the stock climbing 13% from current levels, which feels quite conservative given PDD's continued overseas expansion success and its ability to take share from Alibaba in China. We maintain a strong buy rating on the stock.

Comments