Carvana's Q4 2023 Earnings: A Paradigm Shift in the Used Car Industry

- lelinvestmentllc

- Feb 22, 2024

- 1 min read

Summary

Carvana's stock surged 15% despite a 14% revenue decline in Q4 2023

Record high gross profit per unit (GPU) of $2,812, beating traditional dealerships

$800 million in cash from operations in 2023, showcasing strong cost control

Potential for further expansion into financing, wholesale, and marketplace businesses

A Contradictory Reaction Explained

Despite a 14% drop in Q4 2023 revenues compared to the previous quarter (though better than the 21% decline in Q3), Carvana's stock surged 15% after hours. This seemingly contradictory reaction can be explained by the company's impressive 108% increase in gross profit during the quarter.

Record-Breaking Profitability

Carvana's gross profit per unit (GPU) reached a record high of $2,812, up from $2,692 in Q3. The retail GPU is a crucial metric to watch, as Carvana has consistently outperformed other public used car companies like CarMax and AutoNation in this area.

A Paradigm Shift

This signals a significant paradigm shift, where online used car business models are proving to be more profitable than traditional dealerships. High GPU means that Carvana can leverage its profitability advantage to further expand its market share in the long run, despite the headwinds of declining revenues due to the high-interest rate environment, which has impacted the used car industry.

Strong Cost Control

Moreover, the company managed to generate $800 million in cash from operations in 2023, demonstrating strong cost-control capabilities.

Conclusion

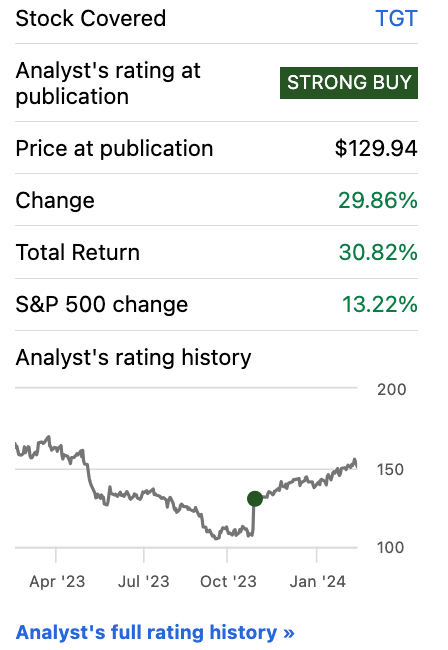

We continue to see Carvana's potential to leverage its leading GPU to expand into other areas such as financing, wholesale, and marketplace businesses. Hence, we maintain our strong buy rating on Carvana.

Comments