Carvana: Why Carvana Skyrocketed Despite Revenue Dip in Q4 Earnings

- lelinvestmentllc

- Feb 23, 2024

- 5 min read

Summary

Carvana's stock soared 30% after Q4 earnings, despite a 14% drop in revenue, due to a 108% increase in gross profit.

Carvana's strong unit economics and potential for long-term growth make it an attractive investment outside of the tech sector.

Carvana's high gross profit per unit and vertically integrated business model position it as a leader in the used car market.

Stock Performance after Q4 Earnings

Carvana's (NYSE:CVNA) stock soared 30% after earnings, even though its revenue dropped 14% from last year. At first glance, that seems contradictory. But it makes sense when you dig into the numbers. The key is that Carvana's gross profit jumped 108% compared to a year ago. That shows they are making a lot more money on each car sold now.

Source: CVNA

Investment Thesis

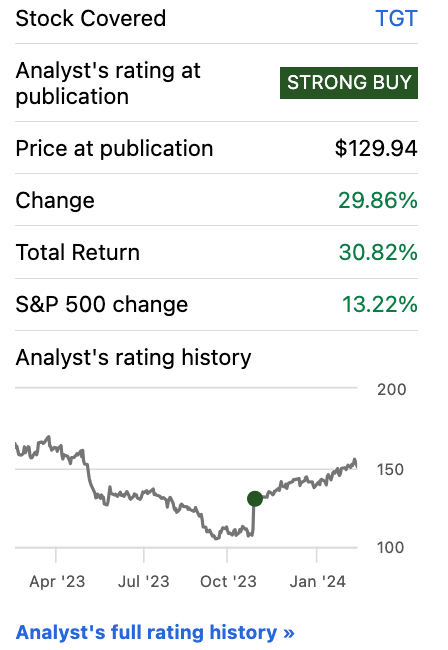

For investors who've been following our coverage, you've hopefully noticed Carvana is up a whopping 890% since we first recommended it back in May 2023. This company has been hated by Wall Street because of its losses while scaling up. But we saw the potential early on.

Carvana is a great example of looking past the short-term noise and investing based on long-term potential. The company's industry-leading unit economics provide a strong competitive advantage that we think will drive growth for years to come.

This is one of those stocks outside the hot AI space that can still deliver strong returns for investors who take the time to dig into the numbers. We view Carvana as a smart diversifier for portfolios heavy on high-flying tech.

Source: Seeking Alpha

Carvana's Profit Leap: A Closer Look

The key thing driving Carvana's strong stock performance after earnings isn't just higher profits. It's that Carvana showed they are the industry leader when it comes to gross profit per unit (GPU) compared to peers such as Carmax (NYSE:KMX)and Autonation (NYSE:AN)

Carvana's retail GPU hit a new record high of $2,812 in the latest quarter, up from $2,692 in the previous quarter. When you add in financing and other services, the total GPU is $4,757. GPU is a crucial number to watch for used car dealers because it shows how competitive their business is.

Source: CVNA,AN,KMX

The Battle for Used Car Market Dominance

Dealerships compete in different ways to attract customers. Carmax uses cheap financing - for customers with good credit they can offer loans as low as 6% compared to 8% at traditional dealers. Meanwhile, AutoNation lowballs used car prices because they make more profit when you trade that car in to buy a new one from them later. They have much higher GPU on new cars, financing, and services.

But at the end of the day, for used cars, it's all about the profit on the car sale and financing since that's how they get customers in the door. So whoever dominates those numbers can dominate the used car market.

Carvana has increased its retail GPU consistently over the past few years. Based on their outlook, they may increase it again next quarter. The bottom line is they're showing they can make more money on each used car than anyone else right now.

Source: CVNA

Direct Sourcing as a Game-Changer

A major reason Carvana has increased its GPU is its vertically integrated business model where it directly sources and sells cars to customers.

Source: CVNA

In 2023, Carvana got 250,000 cars directly from consumers, making up 80% of their sales. Many customers rave on Carvana's website and in reviews about how easy and hassle-free it is to sell your car to them.

Along with their inspection and reconditioning facilities, Carvana now uses their ADESA wholesale locations as parking lots to store cars sourced from customers. This lets them share inventory between their wholesale, marketplace, and retail businesses. That's how they increased retail GPU by $1,100 in the last 6 months compared to 2021.

Carvana's higher GPU signals a major shift - online used car sellers are proving more profitable than old-school dealerships. The high GPU means Carvana can use its profitability edge to take more market share long-term, even with lower sales now due to high-interest rates slowing the used car industry.

Used cars are a fragmented market. So if Carvana has better unit economics than traditional dealers, it's reasonable to think they'll keep growing their share.

Risk: Amazon's Entry into Online Car Sales: A Non-Threat to Carvana

In e-commerce, many retailers struggle because Amazon dominates profits and has a strong competitive moat. Companies like Chewy and Wayfair saw slower growth in 2022 partly due to Amazon.

In 2023, Amazon launched an online car business selling certain brands like Hyundai and Jeep. But we think they just partnered with automakers and don't have a delivery network like Carvana. Nor do they have diverse wholesale and financing businesses to compete on price. So Amazon just validates the online car shopping trend - they aren't a real threat to Carvana.

Valuation

Carvana's Potential Beyond Retail: A Vision for Wholesale Marketplace Success

We see huge potential for Carvana not only in retail but also in moving to a more profitable wholesale marketplace model long-term.

Carvana's current wholesale marketplace GPU matches or even exceeds its retail GPU if you look at non-GAAP numbers. That means Carvana could lift profit margins over time with a more asset-light marketplace model.

Source: CVNA

Source: CVNA

So we're still excited about the upside if the market recognizes Carvana's potential as a used car marketplace, not just a retailer.

Like we wrote before, we think Carvana could be worth $78 per share if valued as a marketplace using current revenue, before accounting for retail and other business. If Carvana maintains industry-leading GPU metrics, it should keep growing its wholesale and marketplace share.

For example, Copart trades at almost 4x Carvana's valuation today thanks to its higher margin marketplace model. We don't expect Carvana to get there overnight. But as long as they lead on key metrics like GPU, we're comfortable holding and buying more when the stock is beaten down.

The bottom line - Carvana has huge potential to transition to a more profitable used car marketplace over time. Their strong unit economics today set them up for success in that model long-term.

Source: Seeking Alpha

Source: Seeking Alpha

Conclusion

Carvana's strong gross profit per unit metrics demonstrate its competitive advantages in used car e-commerce. Their vertically integrated model allows optimization across sourcing, reconditioning, and selling channels. Carvana is well-positioned to gain market share given high customer satisfaction and economies of scale. While macro conditions have impacted sales volumes recently, Carvana's focus on profitability provides optimism. We see significant upside potential as Carvana expands into additional business lines like wholesale, marketplace, and financing leveraging their robust unit economics. Despite short-term headwinds, we remain confident in Carvana's long-term growth story underpinned by industry-leading unit profitability.

Comments