Generative AI Fuels Spotify's Margin Gains in Q4

- lelinvestmentllc

- Feb 6, 2024

- 3 min read

Summary:

Spotify Q4 earnings show improved profitability and user growth

Margin gains driven by generative AI adoption and podcast improvement

Competition from Apple and YouTube remains, but streaming market has room to grow

Valuation still attractive despite 70% stock gain since May 2023

Spotify Q4 2023 Earnings Review

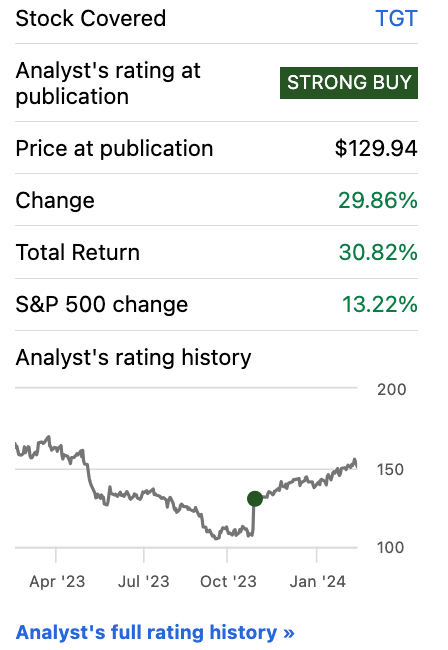

Spotify announced its fourth quarter 2023 earnings on February 6, 2024. Its stock price went up by 8% in premarket trading as a result of improved profitability, continuing userbase growth, and strong free cash flow generation. In fact, Spotify's stock price has increased by 70% since our initial coverage back in May 2023.

Margins and Costs Improve Through AI

In our previous article, "The Huge Potential Behind Spotify's 17% Layoffs (Rating Upgrade)," we envisioned that Spotify has the potential to reach Netflix's valuation, as it has a larger userbase and has been steadily improving its margins due to network effects. We also believe that, as an advertising revenue driven company, Spotify is one of the earliest to benefit from generative AI's ability to streamline operating costs. Hence, we viewed the 17% layoff in December 2023 as a strong catalyst to drive Spotify's stock price upward.

In its Q4 2023 earnings report, Spotify did improve its gross margin and operating margin, with free cash flow reaching record levels.

The company increased its gross margin through both stronger premium gross margin and ad-supported gross margin. Among these positive improvements, we were thrilled to see the ad-supported gross margin increase significantly to 11.6%. This supports our thesis that the advertising business is benefiting from generative AI's ability to streamline operating costs. The year-over-year trends reflect improvement in podcast performance and music profitability, as well as other cost of revenue favorability, partially offset by severance related charges.

Competition Remains, But Market Has Room for Growth

Competition remains a risk. Apple Music and YouTube Music no doubt continue to be top threats to Spotify, as Apple has a larger phone userbase and YouTube Music can leverage YouTube's strong bargaining power against labels and its huge userbase.

Year | Apple Subscribers (millions) | Spotify Subscribers (millions) | Youtube Subscribers (millions) |

2022 | 88 | 205 | 80 |

2023 | 101 | 236 | 100 |

The fact that all three companies grew their user counts in 2023 suggests the streaming music industry is still expanding. We continue to believe there is room for growth, as these three services combined only account for 5% of the world's 8 billion people. We think Spotify's slogan "Music for Everyone" encapsulates the high ceiling of the music streaming market, as Spotify offers affordable pricing in different regions. Hence, we believe there is more upside for Spotify. Furthermore, Spotify still maintains a userbase advantage in terms of size and net adds for 2023. Therefore, we are not overly concerned about competition at this point.

Valuation Still Attractive After Large Stock Gains

Some investors don't think the Spotify to Netflix comparison is valid, as one sells its own content and the other licenses content from others. However, from a consumer perspective, they both provide entertainment to fill time. They both operate on advertising and subscription models, only differing in how they obtain music content through deals with labels. In fact, Spotify has been growing its artist marketplace and owns more content like podcasts, blurring its role as just a content aggregator. We see it gaining increasing leverage over artists to boost profitability.

Hence, Spotify now trades at a discount to Netflix on a price-to-sales and enterprise value-to-sales basis, reflecting its lower profitability. However, we believe there are two drivers to improve its margin: 1) It is still growing its userbase and should gain further leverage to lift margins, and 2) Its advertising business has room to increase profitability as generative AI has just started impacting Spotify in 2023. Therefore, we believe the valuation upside should continue from current levels.

Conclusion

In summary, we were pleased to see Spotify grow its userbase and improve profitability through the low penetration of streaming music and adoption of AI. We believe Spotify's strong network effects should continue to support userbase growth regardless of competition from Apple and YouTube. We believe the current valuation does not yet reflect Spotify's strong potential. We maintain our strong buy rating.

Comments