New Sonos Product Launches in 2024 Could Catalyze Growth

- lelinvestmentllc

- Feb 6, 2024

- 3 min read

Summary

Sonos reported strong Q1 2024 earnings driven by inventory reduction and margin expansion.

We maintain our buy rating on Sonos given its strong brand, customer loyalty, and long-term growth outlook.

Major new product launches planned for 2024, including headphones and a set-top box, could drive growth.

Upside valuation risks include potential for higher margins and market share gains long-term.

Downside risks come from intense competition from tech giants like Apple, Google and Amazon in the speaker market.

Investment Thesis

Sonos reported strong Q1 2024 earnings driven by inventory reduction and gross margin expansion. We maintain our buy rating based on the company's strong brand, customer loyalty, and long-term growth potential, especially with new product launches planned for 2024. Upside risks include higher margins and market share gains; downside risks come from tech competitor innovations.

Sonos Q1 2024 Earnings Review

Sonos stock went up 12% after hours on February 6th 2024 following its Q1 earnings report. The driver was a 50% inventory reduction that generated strong free cash flow and expanded gross margins in the quarter. This suggests Sonos has strong pricing power and ability to clean inventory when necessary.

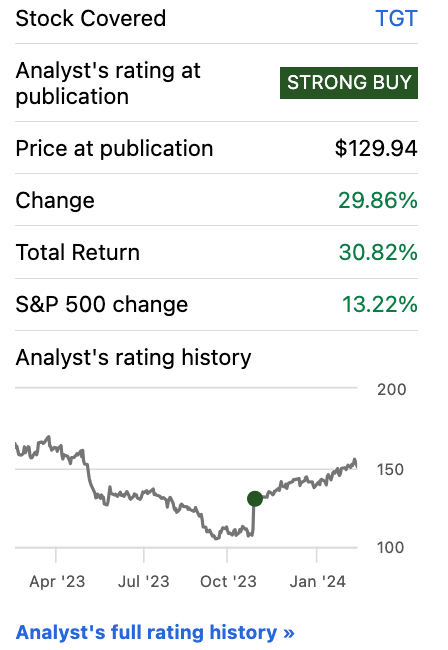

We issued a buy rating on Sonos back in November 2023 since we like its strong brand, high customer loyalty, and long-term growth potential in the speaker sector. The stock is now up 20% since then.

The company seems to have found its bottom as its customer base continued growing despite revenue headwinds in 2023.

2024 Growth Drivers

The CEO is very excited about new products launching in 2024.

We are just months away from announcing our highly anticipated new product in a multi-billion dollar category, which will be the first major milestone of our multi-year product cycle.

These are the main products expected:

Headphones codenamed "Duke" launching in H1 2024 to compete with Apple's AirPods.

A Sonos set-top box called "Pinewood" coming late 2024/early 2025 to take on Roku, Fire TV, and Chromecast.

New speakers, amp, soundbar, and subwoofer from 2024-2025.

Sonos Roam 2 portable speaker called "Sidecar" in mid-2024.

A new Sonos app update called "Passport" in late 2023/early 2024.

We think Sonos' strong brand and loyal customers make the headphone and set-top box launches likely to generate excitement and growth. We will evaluate the impact after launch.

Valuation

Without new products, Sonos seems fairly valued based on management's $100 billion total addressable market (TAM) assumption in our DCF model. Management believes Sonos has 2% share of a $100 billion audio market.

Our DCF uses:

16.1% WACC

3% Terminal Growth

10% Long-Term FCF Margin

5% Long-Term Market Share

When conducting a DCF model valuation, investors should focus more on sensitivity analysis than the final valuation results. The sensitivity analysis shows potential upside and downside scenarios that may not be captured by the financials the company has provided.

Our 10% long-term free cash flow margin assumption is based on management's stated 10% long-term EBITDA margin target. However, this 10% margin estimate seems conservative given Sonos' strong pricing power and loyal customer base. Historically, Sonos achieved a 16% EBITDA margin back in 2021. This suggests there is reason to believe the 10% margin is not the ceiling for this company. If Sonos can further expand margins over time, it gives a basis to increase the long-term margin assumption in the model. For example, if we assume a 15% or 20% long-term margin instead of 10%, it would imply 37-74% additional stock upside.

The market share assumption also plays an important role in the valuation. We assume Sonos can grow from 2% market share today to 5% market share in 10 years, translating to a 14% revenue CAGR. Although management projected flat revenue growth for 2024, they are targeting 7% EBITDA growth this year. Additionally, Sonos grew its user base by 9% in 2023. Given those data points, there seems to be a basis to believe a 14% 10-year CAGR may end up being conservative. If Sonos can continue growing its user base at a high single digit rate annually and has the capacity to expand margins over time, actual market share gains could exceed our assumption. This would provide further upside.

Risks and Competition

Sonos faces strong competition from tech giants like Apple, Google, and Amazon in speakers. But Sonos believes it differentiates through sound quality and network connection. We should monitor how AI improves tech peer smart speaker functionality.

Conclusion

Despite strong competition, Sonos has a loyal customer base and growing product adoption. This establishes switching costs to defend against peers near-term. If user growth continues, Sonos could gain share and improve margins long-term. In our bull case, this implies 37-74% upside. But we'll monitor competitive risks and evaluate the impact of new product launches as potential 2024 catalysts. Risks seem balanced with upside potential, so we rate Sonos a buy.

Comments