Riding the Affirm Coaster: A Detailed Analysis of Stock Volatility Post-Q2 Earnings"

- lelinvestmentllc

- Feb 9, 2024

- 6 min read

Summary

Affirm's stock price has been volatile after Q2 earnings, but we see this as a valuation correction rather than negative business fundamentals

Adjusted operating income and free cash flows show the business economics are sound despite large GAAP losses

Partnerships with retailers like Walmart support Affirm's path to 20% market share

Flat delinquencies are worth monitoring but not alarming yet given strong broader growth

Affirm's Stock Price Rollercoaster After Earnings

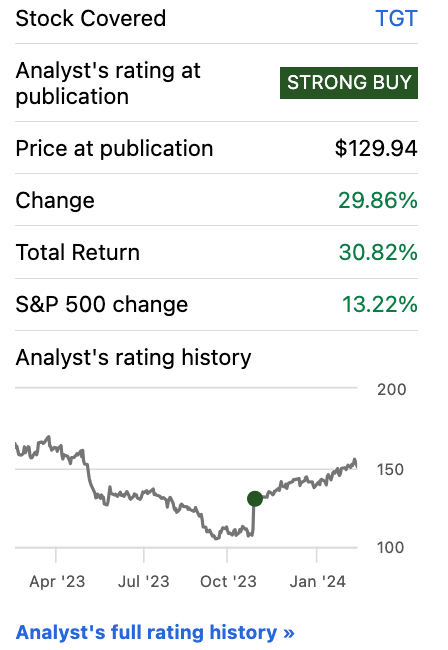

Affirm's (NASDAQ:AFRM) stock price has been on quite a rollercoaster ride lately! As you may remember, we gave Affirm a buy rating back in November 2023, when the stock was around $30. Since then, it climbed nicely to around $40 per share by early February 2024 - a solid 30% gain since our recommendation.

Things got really interesting on the evening of February 9th, when Affirm announced their Q2 2024 earnings. Immediately after the report, the stock shot up to $55, up a whopping 12% in after-hours trading! Investors must have really liked what they saw in the latest numbers.

But the excitement was short-lived. Just hours later, the stock came crashing back down to $37, completely giving up the after-hours pop and then some - ending the night a brutal 25% below the closing price. Ouch!

The next morning, Affirm's stock price fluctuated wildly again. But by the end of the trading session, it had settled back to around $40 per share - right around where it started the day, before the earnings drama.

Valuation Adjustments: Rationalizing Affirm's Market Position

So what should investors make of all this price volatility? In this article, we'll share our perspective on Affirm's latest earnings report and what we think it means for the stock moving forward. The key is looking closely at the fundamentals behind the Q2 numbers, not just the initial market reaction. Stay tuned for our level-headed, long-term outlook!

The quick answer is that this seems to just be a valuation adjustment bringing the stock price more in line with Affirm's fair value. Based on our discounted cash flow (DCF) model, we think the fair value should be around $43.90 per share, which is about 2% below the recent $45 price when we first wrote this analysis.

In our DCF model, we assumed a total addressable market of $6 trillion in US retail sales, an 8% take rate as Affirm's cut of retail transactions, a 20% long-term market share for Affirm, and other assumptions like a 26.7% weighted average cost of capital, 311 million shares outstanding, 3% industry growth rate, and 3% terminal growth rate.

So we're not totally surprised to see the stock drop from $49 down to $45. This doesn't seem to be related to a specific earnings miss or negative news. It's more likely just a correction as investors realize the market had very high expectations baked into Affirm's valuation.

Investor Debates: Key Concerns and Perspectives

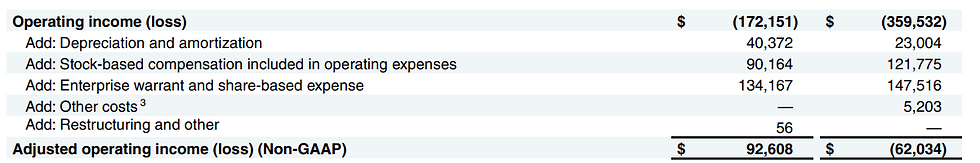

There are two key topics investors are likely debating that could make the stock volatile: (1) Affirm's big net loss of $172 million despite positive adjusted operating income of $92 million this quarter, and (2) whether a 20% long-term market share is achievable for Affirm.

Profitability vs. Growth: The Adjusted Operating Income Debate

On the first point, there are a couple perspectives here.

First, some investors who follow Warren Buffett's philosophy don't think "adjusted operating income" is a useful metric because it adds back non-cash expenses like stock-based compensation (SBC) and enterprise warrant expense. Many investors think high-loss companies are overvalued and due for a crash. So they might describe Affirm as a "meme" stock.

We agree there's some risk of the stock crashing if revenue growth slows. But we don't think "meme stock" is the right label here - that refers more to stocks driven up in the very short term by amateur investors. Meme stocks spike from things like derivatives trading and hedging activity compressing the timeline to just a day or two, whereas institutional buyers have driven Affirm's valuation over a longer period.

Second, for investors who think institutions drive valuations, DCF analysis matters more than profitability. DCF uses cash flows not profits because cash flows represent what investors will actually receive.

For Affirm, we use an 11% free cash flow margin because they generate solid cash flow excluding stock-based expenses. The logic is that stock-based comp could decrease in the future since employees like engineers or even the CEO aren't irreplaceable. If Affirm establishes a loyal customer base and profitable model, the board could reduce things like executive stock awards. Affirm now has a strong customer base and diverse merchant network, so Max Levchin doesn't need to remain CEO forever.

For enterprise warrant expense, Affirm did pay a lot to partner with Amazon and Shopify given their bargaining power. But with initiatives like the Affirm Card, they're building direct relationships beyond those two partners. User loyalty will start to matter more than the Amazon or Shopify partnerships. So even if those partnerships dissolve, Affirm can still operate standalone. This makes the warranty expenses seem more one-time in nature rather than recurring.

And stock compensation is already reflected in the 311 million shares outstanding in our model. Issuing more shares decreases equity per share, but the impact is minor compared to assumptions about long-term cash flow generation. Affirm's 4.8% share increase in 2023 is easily offset if they show higher market share or cash flow margin potential, which brings us to the next point.

Market Share Ambitions: Assessing Affirm's Long-Term Goals

On the 20% market share assumption, Affirm partners with ecommerce giants representing over 50% of the market. Losing one of those would be a major blow. But the recent Walmart partnership provides some cushion, further supporting the 20% long-term share as reasonable.

Overall, we think there's upside for the stock if Affirm keeps improving adjusted operating margins and securing big partnerships like Walmart. In our sensitivity analysis, long-term cash flow margins showed over 30% upside potential.

Additional major retailer deals should reduce reliance on any single platform, providing valuation support. Downside risks could be as much as 50% in a worst case scenario per our sensitivity analysis. But we think the fundamentals back a fair value around $44.

The Financial Health Check: Affirm's Quarterly Metrics

Looking closely at Affirm's financials this quarter, they actually seem to be doing quite well by most key metrics. Growth looks solid for total payment volume (GMV), revenue, customer base, and earnings.

Delinquency Rates: A Potential Yellow Flag?

The only potential concern we see is that their Q2 delinquency rate remained flat at 2.4%, the same as Q1. Typically Affirm experiences a seasonal decline in delinquencies in Q2 based on historical trends. So the flat rate could signal some worsening of their customer credit profile going forward.

However, we'd characterize this more as a yellow flag rather than a red flag for a couple reasons. First, Affirm's delinquency rates still outperform industry peers, so they have room before reaching alarming levels.

And more importantly, Affirm doesn't hold most loans for long - they sell them off to asset managers. As long as Affirm is pricing appropriately and getting good yields on loan sales, the current 2.4% delinquency isn't dire. It's not ideal, but not the end of the world either.

The charts suggest interest-bearing loan rates are remaining stable and increasing as a percentage of the mix, while 0% APR loans are still healthy and rising for longer duration loans.

Even if Affirm gets stuck holding loans temporarily during market hiccups, the short duration of most loans should limit risk exposure.

Even if Affirm gets stuck holding loans temporarily during market hiccups, the short duration of most loans should limit risk exposure.

While we acknowledge the market can turn quickly, Affirm's own assessment is that there are no major issues as of now.

The flat delinquencies are worth monitoring, but the broader financial picture still looks quite strong this quarter by our take. We'll be keeping a close eye on credit trends, but see this more as a caution flag than emergency alarm.

Conclusion

In our previous article, we laid out our views on how Affirm's valuation should be assessed. Our take is that Affirm is in the process of building a loyal customer base and diversifying beyond reliance on any single retailer. These efforts to stand on their own should help strengthen Affirm's competitive position over time.

The current partnerships with major retailers are crucial to help Affirm scale up and cement itself as one of the leading payment providers in the US market. We see the risk-reward as balanced right now but skewing positive overall.

There are certainly uncertainties, but Affirm appears to be executing well on their strategy of becoming an embedded payments option that consumers actively choose. As this brand affinity grows, it will be harder for retailers to drop Affirm even if they wanted to.

The recent earnings volatility is expected in a high-growth company pioneering a new category. We reiterate our bullish view on the long-term business fundamentals. Affirm's management team has built innovative products before, and we believe they can do it again here.

In summary, we maintain our buy rating on Affirm's stock. The company's progress makes us confident they are on track to deliver strong returns for shareholders over the next 3-5 years as adoption of "buy now pay later" payments gains momentum.

Comments